'Pre-approvals out the door': Proposed mortgage rules could make home-buying more challenging

While signs are pointing towards renewed activity for Canada's real estate market, proposals to mortgage lending guidelines may make qualifying much more difficult.

The Office of the Superintendent of Financial Institutions (OSFI), the country's federal banking regulator, released its proposals for the first phase of the B-20 mortgage underwriting rules review in January.

The potential changes and additions include:

- Establishing a loan-to-income threshold could prevent borrowers from qualifying for homes worth more than 4.5 times their income.

- Establishing debt servicing rules for uninsured borrowers already in place with insured and insurable mortgages.

- Enhancing a previously introduced stress test to include more stringent affordability tests for higher-risk products.

The review results from higher risks in borrowing and loans that have increased yearly.

"They all point towards the same result," said Michael Oziel, a mortgage broker with Sherwood Mortgage Group. "They're trying to lower how much mortgage debt Canadians can take out."

But those in the mortgage industry, such as Oziel, are concerned about the adverse effects the proposals could have on Canadian Real Estate.

"My take on it, it's already difficult enough to qualify," Oziel added. "It's going to reduce the overall mortgage that a Canadian can take out even further."

Industry experts say increasing interest rates and record consumer debt concern everyone within the Canadian financial sector.

But according to the Canadian Mortgage Brokers Association (CMBA) of Ontario, the proposals, as they stand, might be going about it the wrong way.

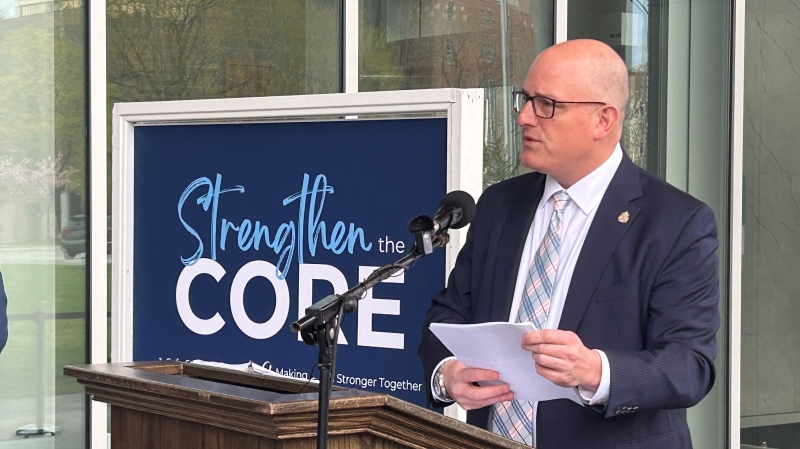

"Pre-approvals would essentially go out the door," said Sadiq Boodoo, CMBA Ontario President. "It's going to become such a laborious task in order for somebody to fit into this really tiny box."

The CMBA is one stakeholder currently taking part in consultations with the federal regulator. Boodoo said it's still working on its suggestions to provide OSFI with feedback.

"We're also advocating to make it easier for first-time home buyers to enter the market," Boodoo said. "Let's give you a 40-year amortization on that first purchase; if you refinance or buy another, now you're subject to the same 30 or 25 years like everybody else, but let's make it more affordable to at least get in once."

The rules would be in addition to the existing regulations around minimum qualifying rates, known as the mortgage stress test.

It forces borrowers to qualify for a mortgage at a 5.25 per cent interest rate, or two percentage points above the contract rate, with the higher of the two being the threshold.

Responses to this first phase of the review are due on April 14.

CTVNews.ca Top Stories

Countries struggle to draft 'pandemic treaty' to avoid mistakes made during COVID

After the coronavirus pandemic triggered once-unthinkable lockdowns, upended economies and killed millions, leaders at the World Health Organization and worldwide vowed to do better in the future. Years later, countries are still struggling to come up with an agreed-upon plan for how the world might respond to the next global outbreak.

NEW Iconic Canadian song turns 50

Andy Kim's 'Rock Me Gently' is marking a major milestone, as it celebrates its 50th anniversary.

Oprah Winfrey: I set an unrealistic standard for dieting

Oprah Winfrey said on Thursday evening that she has long played a role in promoting unhealthy and unrealistic diets.

Ontario family receives massive hospital bill as part of LTC law, refuses to pay

A southwestern Ontario woman has received an $8,400 bill from a hospital in Windsor, Ont., after she refused to put her mother in a nursing home she hated -- and she says she has no intention of paying it.

Flat tire on a highway? Here's why you shouldn't try to fix it

If you're cruising down a highway and realize you have a flat tire, you may want to think twice before stopping to fix it on the side of the road.

From outer space? Sask. farmers baffled after discovering strange wreckage in field

A family of fifth generation farmers from Ituna, Sask. are trying to find answers after discovering several strange objects lying on their land.

Broadcaster and commentator Rex Murphy dead at 77: National Post

The National Post is reporting that Rex Murphy, the pundit and columnist who hosted a national call-in radio show for decades, has died.

Whooping cough outbreak declared in Newfoundland

Health officials say there is an outbreak of whooping cough in eastern Newfoundland.

Miss Teen USA steps down just days after Miss USA's resignation

Miss Teen USA resigned Wednesday, sending further shock waves through the pageant community just days after Miss USA said she would relinquish her crown.