Romance schemes and fake income tax extortions were just some of the top ten biggest scams that bilked Canadians out of approximately $121 million in 2018, according to the Better Business Bureau.

As part of its fraud prevention month, the BBB released its annual list of the most common ways fraudsters target unsuspecting victims. The list also included tips on how to avoid becoming the victim of a fraudulent scheme.

Because victims can sometimes feel ashamed, their estimate only accounts for roughly five per cent of scam cases, which were reported to police. The agency estimates losses could be as high as $3 billion.

- For a full rundown on the list, scroll to the bottom of the article.

One of the biggest scams that duped people out of at least $22.5 million was so-called “catphishing” through online dating. This is when scammers create fake online profiles to seduce victims into giving them money.

Meanwhile, Canadians lost $6 million from scammers who pretended to work for the Canada Revenue Agency who then extorted victims through threatening phone calls, texts or phishing emails.

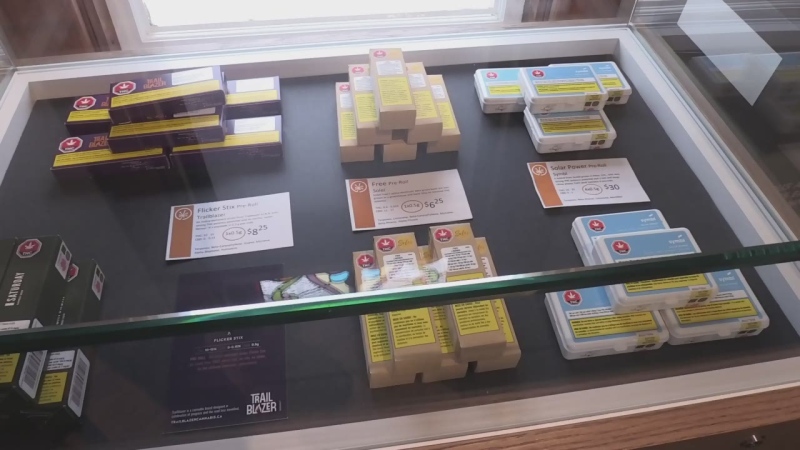

Coming in third place were online purchase scams which cost Canadians $3.5 million, the BBB found. These scams can involve counterfeit goods, people giving up personal information to fake websites or free trials, or fraudulent cheques being sent by people on sites like Kijiji or Craigslist.

Over $4.5 million was lost due to employment scams that typically involve scammers sending fake cheques containing significant overpayments, which then prompt victims to forward the excess funds to someone else -- likely the scammers themselves.

There were also unknown millions lost to home improvement scams; phishing scams from fraudulent websites; and fake celebrity endorsements or “free” trials, which dupe victims into inadvertently signing up for expensive subscriptions.

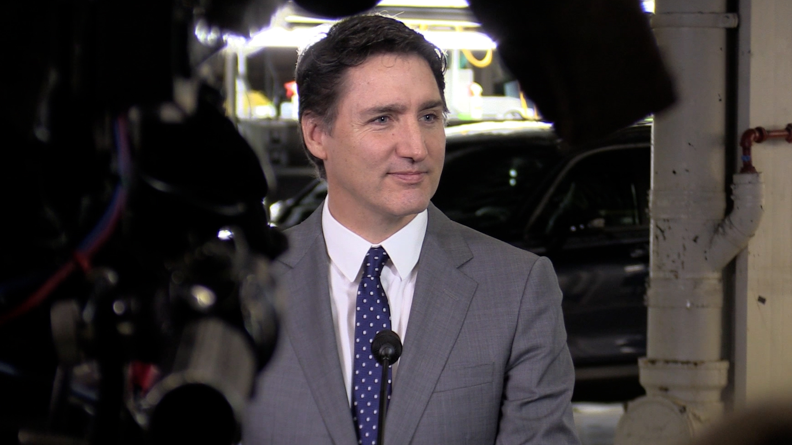

When it came to these predatory subscription scams, Competition Bureau of Canada's law officer Nicola Pfeifer told CTV Vancouver that “once you’re in, it’s hard to get out.”

Dating sites aren’t bad per se; more millennials targeted

As for romance schemes, the Canadian Anti-Fraud Centre’s acting call centre and intake unit manager Jessica Gunson told CTVNews.ca earlier this month that there isn’t anything wrong with dating sites per se.

But “what (you) need to know is that there are dangers that lie within there,” she said. Sgt. Guy Paul Larocque of the RCMP agreed and warned people to be wary of relationships that move too quickly.

“We are talking about a new relationship with someone you met online that seems too good to be true and that grows really fast,” he said in a statement. “The person seems overly eager to meet you until something happens… (and) they suggest they need money from you.”

In terms of who is targeted, the BBB said scammers have been setting their sights on millenials more often lately.

The Competition Bureau of Canada's law officer Nicola Pfeifer told CTV Toronto the internet has become "powerful enough that it’s expanding the reach of fraudulent crime well beyond the traditional vulnerable consumer groups of seniors, children, and new Canadians.”

She added because of millennials’ “disproportionate presences online… they’ve become natural targets for fraudsters.”

The top ten scams of 2018 and approximately how much it cost Canadians:

- Romance scams: More than $22.5 million

- Income tax extortion scam: More than $6 million

- Online purchase scams: More than $3.5 million

- Employment scams: More than $4.5 million

- Phishing: Losses unknown

- Subscription scams: Losses unknown

- Advance fee loans: Nearly $1 million

- Tech support scams: Nearly $1 million

- Home improvement scams: Losses unknown

- Bank investigator scams: More than $2 million