'Pre-approvals out the door': Proposed mortgage rules could make home-buying more challenging

While signs are pointing towards renewed activity for Canada's real estate market, proposals to mortgage lending guidelines may make qualifying much more difficult.

The Office of the Superintendent of Financial Institutions (OSFI), the country's federal banking regulator, released its proposals for the first phase of the B-20 mortgage underwriting rules review in January.

The potential changes and additions include:

- Establishing a loan-to-income threshold could prevent borrowers from qualifying for homes worth more than 4.5 times their income.

- Establishing debt servicing rules for uninsured borrowers already in place with insured and insurable mortgages.

- Enhancing a previously introduced stress test to include more stringent affordability tests for higher-risk products.

The review results from higher risks in borrowing and loans that have increased yearly.

"They all point towards the same result," said Michael Oziel, a mortgage broker with Sherwood Mortgage Group. "They're trying to lower how much mortgage debt Canadians can take out."

But those in the mortgage industry, such as Oziel, are concerned about the adverse effects the proposals could have on Canadian Real Estate.

"My take on it, it's already difficult enough to qualify," Oziel added. "It's going to reduce the overall mortgage that a Canadian can take out even further."

Industry experts say increasing interest rates and record consumer debt concern everyone within the Canadian financial sector.

But according to the Canadian Mortgage Brokers Association (CMBA) of Ontario, the proposals, as they stand, might be going about it the wrong way.

"Pre-approvals would essentially go out the door," said Sadiq Boodoo, CMBA Ontario President. "It's going to become such a laborious task in order for somebody to fit into this really tiny box."

The CMBA is one stakeholder currently taking part in consultations with the federal regulator. Boodoo said it's still working on its suggestions to provide OSFI with feedback.

"We're also advocating to make it easier for first-time home buyers to enter the market," Boodoo said. "Let's give you a 40-year amortization on that first purchase; if you refinance or buy another, now you're subject to the same 30 or 25 years like everybody else, but let's make it more affordable to at least get in once."

The rules would be in addition to the existing regulations around minimum qualifying rates, known as the mortgage stress test.

It forces borrowers to qualify for a mortgage at a 5.25 per cent interest rate, or two percentage points above the contract rate, with the higher of the two being the threshold.

Responses to this first phase of the review are due on April 14.

CTVNews.ca Top Stories

B.C. tenants evicted for landlord's use after refusing large rent increase to take over neighbouring suite

Ashley Dickey and her mother rented part of the same Coquitlam duplex in three different decades under three different landlords.

Mountain guide dies after falling into a crevasse in Banff National Park

A man who fell into a crevasse while leading a backcountry ski group deep in the Canadian Rockies has died.

opinion The special relationship between King Charles and the Princess of Wales

Royal commentator Afua Hagan writes that when King Charles recently admitted Catherine to the Order of the Companions of Honour, it not only made history, but it reinforced the strong bond between the King and his beloved daughter-in-law.

Expert warns of food consumption habits amid rising prices

A new survey by Dalhousie University's Agri-Food Analytics Lab asked Canadians about their food consumption habits amid rising prices.

MPP Sarah Jama asked to leave Ontario legislature for wearing keffiyeh

MPP Sarah Jama was asked to leave the Legislative Assembly of Ontario by House Speaker Ted Arnott on Thursday for wearing a keffiyeh, a garment which has been banned at Queen’s Park.

Charlie Woods, son of Tiger, shoots 81 in U.S. Open qualifier

Charlie Woods failed to advance in a U.S. Open local qualifying event Thursday, shooting a 9-over 81 at Legacy Golf & Tennis Club.

Ex-tabloid publisher testifies he scooped up possibly damaging tales to shield his old friend Trump

As Donald Trump was running for president in 2016, his old friend at the National Enquirer was scooping up potentially damaging stories about the candidate and paying out tens of thousands of dollars to keep them from the public eye.

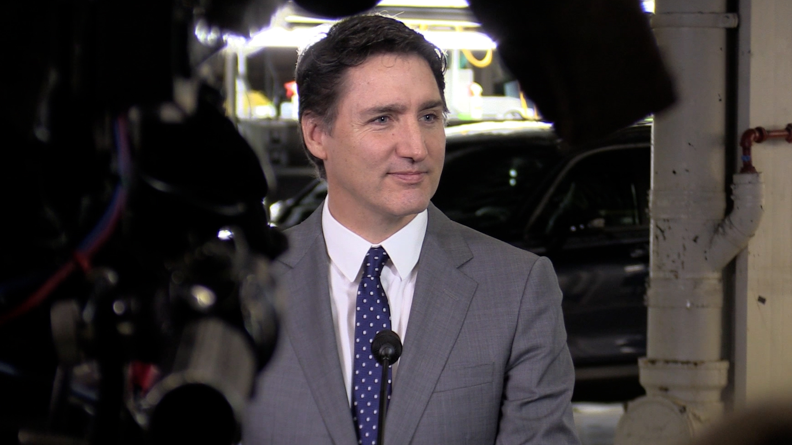

Here's why provinces aren't following Saskatchewan's lead on the carbon tax home heating fight

After Prime Minister Justin Trudeau said the federal government would still send Canada Carbon Rebate cheques to Saskatchewan residents, despite Saskatchewan Premier Scott Moe's decision to stop collecting the carbon tax on natural gas or home heating, questions were raised about whether other provinces would follow suit. CTV News reached out across the country and here's what we found out.

Montreal actress calls Weinstein ruling 'discouraging' but not surprising

A Montreal actress, who has previously detailed incidents she had with disgraced Hollywood producer Harvey Weinstein, says a New York Court of Appeals decision overturning his 2020 rape conviction is 'discouraging' but not surprising.