Collingwood budget passed with under 3 per cent tax increase

Councillors in Collingwood have officially approved the budget for 2023.

At Monday night's meeting, council gave the green light to the budget, which comes with a 2.7 per cent increase in property taxes. The town says that equates to approximately $5.30 for the average household in Collingwood.

"Many people are struggling in our community as the price of almost everything continues to rise," Mayor Yvonne Hamlin said in a news release. "With inflation over 6%, we worked hard to keep the property tax rate increase affordable, while still ensuring that our Town is a wonderful place to live, work and play."

According to the town, the key priorities of the budget include $225,000 in top-up funds to the Affordable Housing Reserve Fund and continuing to maintain the same level of programs and services.

Altogether the budget includes $ 66.7 million in operating expenses and $ 63.3 million in capital expenses.

The town will also be investing in various community spaces, including local arenas, as well as a $500,000 investment in the ongoing revitalization of the grain terminals.

"Council and Staff also want to ensure we plan for our community's future in a fiscally responsible way," Monica Quinlan, a treasurer, said in a news release. "This includes planning for the future and caring for our assets in a manner that is responsible and cost-effective."

CTVNews.ca Top Stories

B.C. tenants evicted for landlord's use after refusing large rent increase to take over neighbouring suite

Ashley Dickey and her mother rented part of the same Coquitlam duplex in three different decades under three different landlords.

Mountain guide dies after falling into a crevasse in Banff National Park

A man who fell into a crevasse while leading a backcountry ski group deep in the Canadian Rockies has died.

Expert warns of food consumption habits amid rising prices

A new survey by Dalhousie University's Agri-Food Analytics Lab asked Canadians about their food consumption habits amid rising prices.

MPP Sarah Jama asked to leave Ontario legislature for wearing keffiyeh

MPP Sarah Jama was asked to leave the Legislative Assembly of Ontario by House Speaker Ted Arnott on Thursday for wearing a keffiyeh, a garment which has been banned at Queen’s Park.

Charlie Woods, son of Tiger, shoots 81 in U.S. Open qualifier

Charlie Woods failed to advance in a U.S. Open local qualifying event Thursday, shooting a 9-over 81 at Legacy Golf & Tennis Club.

Ex-tabloid publisher testifies he scooped up possibly damaging tales to shield his old friend Trump

As Donald Trump was running for president in 2016, his old friend at the National Enquirer was scooping up potentially damaging stories about the candidate and paying out tens of thousands of dollars to keep them from the public eye.

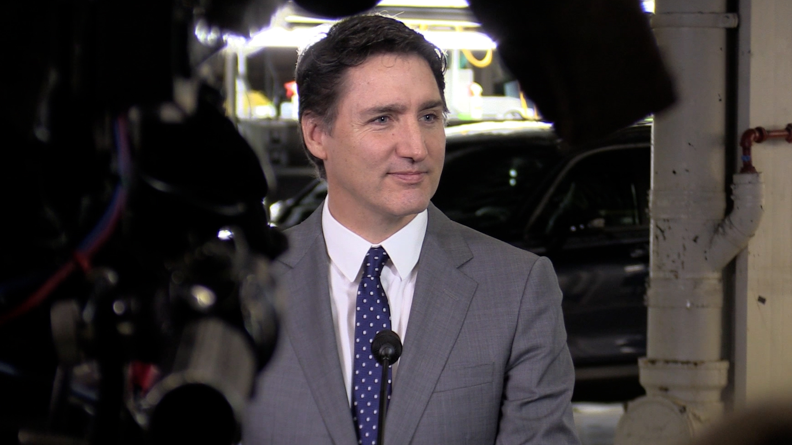

Here's why provinces aren't following Saskatchewan's lead on the carbon tax home heating fight

After Prime Minister Justin Trudeau said the federal government would still send Canada Carbon Rebate cheques to Saskatchewan residents, despite Saskatchewan Premier Scott Moe's decision to stop collecting the carbon tax on natural gas or home heating, questions were raised about whether other provinces would follow suit. CTV News reached out across the country and here's what we found out.

Montreal actress calls Weinstein ruling 'discouraging' but not surprising

A Montreal actress, who has previously detailed incidents she had with disgraced Hollywood producer Harvey Weinstein, says a New York Court of Appeals decision overturning his 2020 rape conviction is 'discouraging' but not surprising.

Caleb Williams, Jayden Daniels and Drake Maye make it four NFL drafts with quarterbacks going 1-3

Caleb Williams is heading to the Windy City, aiming to become the franchise quarterback Chicago has sought for decades.