Barrie restaurants, bars brace for most significant alcohol tax jump in 40 years

Canada's restaurant industry is bracing for the biggest jump in the country's alcohol excise duty in more than 40 years, spurring warnings the tax hike could force some bars and restaurants out of business.

As of April 1, a 6.3 per cent tax increase on wine, beer and spirits comes into effect.

"I was hoping that the government would take a little pity on us after all we've been through over the last two or three years. We've had supply chain issues, rising costs all the way from beer to liquor, and now we have labour shortages, so it just kind of piles on," said Yvette Wicksted, owner of Bull & Barrel Pub.

Donaleigh's Irish Public House manager Colin Johnson called the situation less than ideal.

"I mean, when you break it down, it's a few pennies per bottle per ounce but any little bit after the last few years that we've had is kind of a hindrance to the ability to do business," he said.

Johnson added that at Donaleigh's, prices would not be raised immediately, but "Prices will eventually have to go up, I mean, you have to, but right away, we're going to sit back and see how everything unfolds, and then we will have to react accordingly."

The tax increase is a big hike for wineries, especially after another recent increase in June.

"It's absolutely huge, and it's coming off some tough years when business hasn't had a chance to recoup. Ontario lost a trade complaint to Australia regarding our wine industry, and all VQA wineries in Ontario are being subject to a new tax on the back end as well," said Walter Vaz, Heritage Estates Winery and Cidery. "So, it's kind of a huge double whammy at a time when we can't afford any increases."

Regional Vice President of Ontario with Restaurants Canada Tracy Macgregor said the increase is a big concern for its operators.

"We're seeing a lot of different compounding costs for our operators, and they're coming frankly out of a period of mounted debt, numerous increases," said Macgregor.

She noted the 6.3 per cent tax increase would cost an average full-service restaurant around $30,000.

Restaurants Canada officials hope the tax hike is deferred or reduced to a lower percentage.

CTVNews.ca Top Stories

B.C. tenants evicted for landlord's use after refusing large rent increase to take over neighbouring suite

Ashley Dickey and her mother rented part of the same Coquitlam duplex in three different decades under three different landlords.

MPP Sarah Jama asked to leave Ontario legislature for wearing keffiyeh

MPP Sarah Jama was asked to leave the Legislative Assembly of Ontario by House Speaker Ted Arnott on Thursday for wearing a keffiyeh, a garment which has been banned at Queen’s Park.

Mountain guide dies after falling into a crevasse in Banff National Park

A man who fell into a crevasse while leading a backcountry ski group deep in the Canadian Rockies has died.

Expert warns of food consumption habits amid rising prices

A new survey by Dalhousie University's Agri-Food Analytics Lab asked Canadians about their food consumption habits amid rising prices.

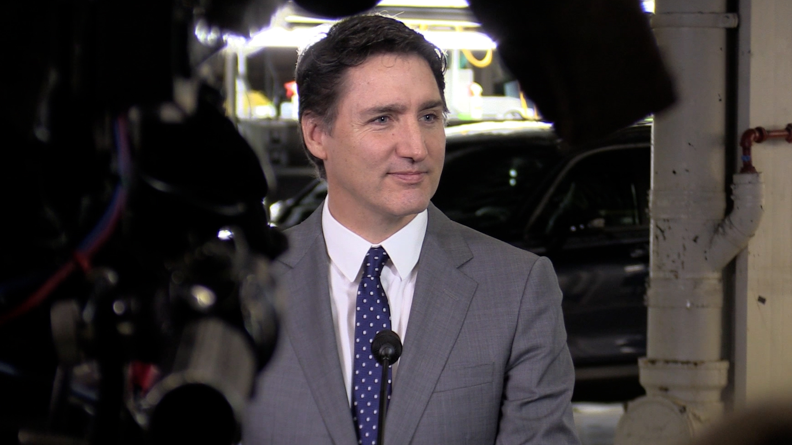

Here's why provinces aren't following Saskatchewan's lead on the carbon tax home heating fight

After Prime Minister Justin Trudeau said the federal government would still send Canada Carbon Rebate cheques to Saskatchewan residents, despite Saskatchewan Premier Scott Moe's decision to stop collecting the carbon tax on natural gas or home heating, questions were raised about whether other provinces would follow suit. CTV News reached out across the country and here's what we found out.

Montreal actress calls Weinstein ruling 'discouraging' but not surprising

A Montreal actress, who has previously detailed incidents she had with disgraced Hollywood producer Harvey Weinstein, says a New York Court of Appeals decision overturning his 2020 rape conviction is 'discouraging' but not surprising.

Charlie Woods, son of Tiger, shoots 81 in U.S. Open qualifier

Charlie Woods failed to advance in a U.S. Open local qualifying event Thursday, shooting a 9-over 81 at Legacy Golf & Tennis Club.

Caleb Williams, Jayden Daniels and Drake Maye make it four NFL drafts with quarterbacks going 1-3

Caleb Williams is heading to the Windy City, aiming to become the franchise quarterback Chicago has sought for decades.

Improve balance and build core strength with this exercise

When it comes to cardiovascular fitness, you may tend to focus on activities that move you forward, such as walking, running and cycling.