Local craft breweries are happy with the Ontario government’s new support program, but there are some problems that still need fixing.

Ontario is establishing a $4.9-million support program for small distillers and cideries. The program will give eligible distillers up to $4.42 per litre of sales made to the LCBO, to establishments with liquor licences, and at on-site retail stores.

Cideries will get up to 74 cents per litre on sales made to the LCBO and restaurants, bars and venues with liquor licences.

Both distillers and cideries can receive up to $220,000 per year.

Business has been booming for Barnstormer in Barrie. They have seen 120 per cent growth in production in the last year.

“I do see increased in volume, I do see increased in need for equipment, I do see increased need for jobs,” says Dustin Norlund, owner.

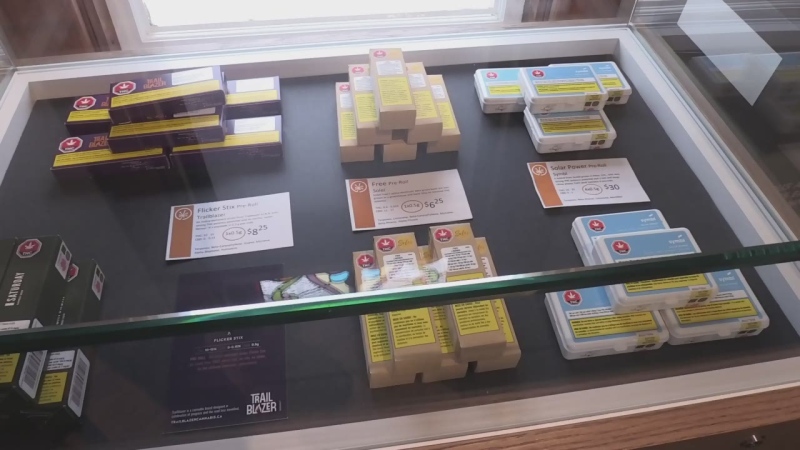

But Norland admits there's a bigger problem. Spirits, for example, have stricter government rules about price markup, than craft beer.

“The distilling side has definitely been frowned upon in the past simply because of the LCBO taking the 143 per cent markup from things going off of our own retail store shelf.”

Local cider producers also say they are taxed too heavily compared to similar craft industries.

“The reality is we're being taxed like wine and competing with beer. We are being taxed almost 50 cents more a can in the LCBO than craft beer,” Peter McArthur, owner of Heritage Estate Winery and Cidery.

McArthur is welcoming the program that will see him get a portion of that money back through sales at the LCBO to invest in his business.

“For us it means increased production, it means increased revenue that will allow us to scale up to meet demand.”

But he, like other small spirit and cider producers, still feel the government takes too much money out of their pockets.

The hope is that the government will come up with a lasting solution for the industry beyond this three year program so that these investments don't go to waste.

With files from The Canadian Press.