Mortgage brokers encouraged by renewed interest in home buying and renewals

A hold in the Bank of Canada's key interest rate might turn the tide for financing homes across Canada.

- Download the CTV News app to get local alerts on your device

- Get the latest local updates sent to your email inbox

Mortgage brokers in Simcoe County and the surrounding area are encouraged by the return of buyers to the market and renewals amid concerns of future defaults this year.

"As much as people want to buy bigger houses and things like that, they have been limited in terms of those higher rates," said Jason Nugent, a mortgage broker with Dominion Lending in Newmarket. "But because of the halt on hikes, we've actually seen some optimism return to those seeking to re-enter the market."

The Bank of Canada's halt on rate hikes occurred earlier this month after a year of hikes to slow down inflation nationwide.

"In fact, we've actually seen a little bit of a reduction in the rates in the last week or so," said Michael Oziel, Mortgage Broker with Sherwood Mortgage Group. "We're starting to see a lot of buyers coming off the sidelines and get back into the pre-approval process."

However, only some have been able to qualify for conventional mortgages.

A November 2022 report from CMHC revealed 33 per cent of borrowers renewed with alternative lenders in the third quarter of 2022, up from 29 per cent the year prior.

"When you look at the gig economy, people working hourly, two or three jobs, the banks have certain restrictions about how much time you have to be on that job before we can use that income," Nugent said. "So we have seen a small increase in defaults, but we're still very stable."

Simcoe County's default rate currently sits at 0.47, which Michael Oziel said is a sign of resiliency.

"How people have been ensuring that their finances are in order to withstand these rates, I'm actually quite impressed with how low defaults have been," he added.

CTVNews.ca Top Stories

B.C. tenants evicted for landlord's use after refusing large rent increase to take over neighbouring suite

Ashley Dickey and her mother rented part of the same Coquitlam duplex in three different decades under three different landlords.

Mountain guide dies after falling into a crevasse in Banff National Park

A man who fell into a crevasse while leading a backcountry ski group deep in the Canadian Rockies has died.

Expert warns of food consumption habits amid rising prices

A new survey by Dalhousie University's Agri-Food Analytics Lab asked Canadians about their food consumption habits amid rising prices.

MPP Sarah Jama asked to leave Ontario legislature for wearing keffiyeh

MPP Sarah Jama was asked to leave the Legislative Assembly of Ontario by House Speaker Ted Arnott on Thursday for wearing a keffiyeh, a garment which has been banned at Queen’s Park.

Charlie Woods, son of Tiger, shoots 81 in U.S. Open qualifier

Charlie Woods failed to advance in a U.S. Open local qualifying event Thursday, shooting a 9-over 81 at Legacy Golf & Tennis Club.

Ex-tabloid publisher testifies he scooped up possibly damaging tales to shield his old friend Trump

As Donald Trump was running for president in 2016, his old friend at the National Enquirer was scooping up potentially damaging stories about the candidate and paying out tens of thousands of dollars to keep them from the public eye.

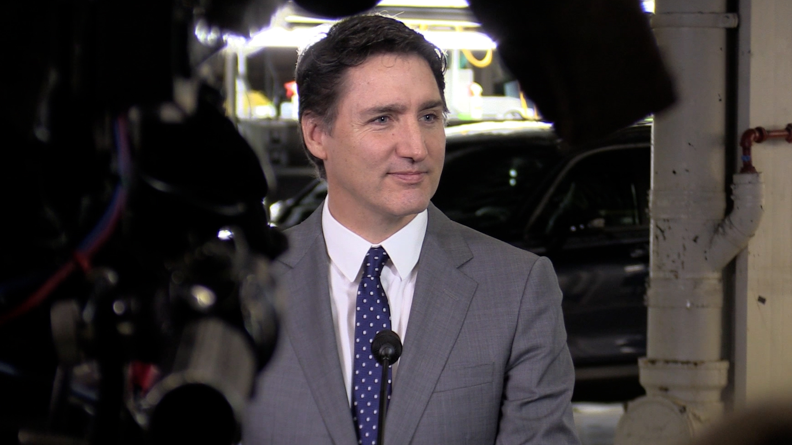

Here's why provinces aren't following Saskatchewan's lead on the carbon tax home heating fight

After Prime Minister Justin Trudeau said the federal government would still send Canada Carbon Rebate cheques to Saskatchewan residents, despite Saskatchewan Premier Scott Moe's decision to stop collecting the carbon tax on natural gas or home heating, questions were raised about whether other provinces would follow suit. CTV News reached out across the country and here's what we found out.

Montreal actress calls Weinstein ruling 'discouraging' but not surprising

A Montreal actress, who has previously detailed incidents she had with disgraced Hollywood producer Harvey Weinstein, says a New York Court of Appeals decision overturning his 2020 rape conviction is 'discouraging' but not surprising.

Caleb Williams, Jayden Daniels and Drake Maye make it four NFL drafts with quarterbacks going 1-3

Caleb Williams is heading to the Windy City, aiming to become the franchise quarterback Chicago has sought for decades.