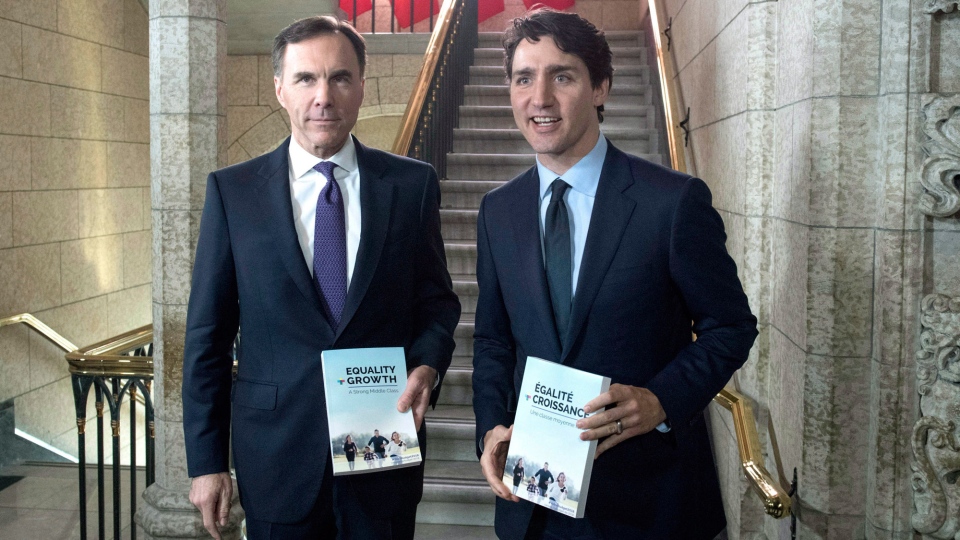

Finance Minister Bill Morneau tabled a federal budget Tuesday that charts a clear course for the Liberals to the 2019 election, an aspirational road map designed to ensure that no woman, scientist or national wildlife area gets left behind.

"It is a plan that puts people first -- that invests in Canadians and in the things that matter most to them," Morneau told the House of Commons in his budget speech.

The document, which details a $18.1-billion deficit, including a $3-billion adjustment for risk, also shows the Liberal government is doubling down on the idea that spending money -- even borrowed money -- is good for the long-term future of Canadians.

Once again, there is also no timeline for getting back to black.

"We've shown to Canadians that making investments in them, making investments to allow more Canadians to be working, has exactly the positive impact that we want it to have," Morneau told a news conference Tuesday when pressed on that point.

The Liberals are making that argument most strongly when devoting those dollars to causes near to their progressive hearts, as well as to those of Canadians who might be thinking about casting a ballot their way in October of next year.

The budget, as expected, puts a large emphasis on gender equality, particularly with efforts to increase the participation of women in the workforce as part of a longer-term plan to grow the economy and prepare for the consequences of an aging population.

"We know that the way to best impact our long-term demographics is to get every Canadian with a real and fair chance not only work, but to have really good work, and we start with women," Morneau said before the budget was tabled.

"If half of our population are held back, we're just not going to be as successful."

One big part of that plan is to introduce up to five weeks of leave -- with employment insurance benefits that come with a starting cost of $1.2 billion over five years -- for new fathers, as a way to help break the pattern of mothers automatically taking on the greater share child-rearing responsibilities, and losing earning power as a result.

It also includes measure to boost the number of women entrepreneurs, as well as those in the trades and the fields of science, technology, engineering and math.

The budget, for the first time in Canadian history, also went through a full gender-based analysis, which involved thinking about how every single measure would impact men, women, boys and girls in different ways, while taking other intersecting factors such as age, ethnicity, income and disability into account.

The Liberals are also promising legislation that would enshrine gender-based analysis in the budget-making process, forcing themselves -- and, technically, future governments -- to repeat the exercise every year and continue tracking their progress on equality.

Throughout the budget, the Liberals also declared a goal of getting better at collecting the data required to do a deeper dive.

There was no additional money for child care this year however, although the Liberals feel they dealt with that in the previous budget: $7.5 billion over 11 years for bilateral deals with the provinces and territories.

Economist Armine Yalnizyan said that since the wages of women of child-bearing age reached a plateau a decade ago, bigger investments in child care spaces would likely have the biggest impact on the stated goal of increasing the participation of women in the workforce.

"It's really frustrating that they want women to help with economic growth, but they won't help women -- this year," Yalnizyan said.

That overarching theme of gender equality aside, the budget is also a smattering of smaller measures, with the long, scattershot list at the back of the 367-page document including everything from money to repair and maintain the graves of veterans and expanding the tax credit for service dogs to help people with post-traumatic stress disorder.

Still, other themes emerge, including major investments in science, the environment and reconciliation with Indigenous Peoples, which are all areas Prime Minister Justin Trudeau's government sees as part of its progressive vision for the country and the world.

It also allows the Liberals to continue telling a story that sets them up in contrast to the Conservatives.

That includes $3.2 billion over five years for investing in Canadian scientists and researchers, as well as $1.3 billion over five years to help Canada meet a United Nations commitment to protect at least 17 per cent of its land and inland waters by 2020.

The budget also announced the creation of an advisory council -- to be chaired by Dr. Eric Hoskins, who resigned Monday as Ontario health minister -- to begin exploring options for a national pharmacare plan, although Morneau did not promise that would be ready in time for the 2019 vote.

That will be one way for Trudeau to try to outflank NDP Leader Jagmeet Singh, who has made bringing Canadians universal access to affordable prescription drugs a top priority.

Highlights from the federal Liberal budget tabled Tuesday by Finance Minister Bill Morneau:

- "Proactive" pay equity legislation, as well as $3 million over five years for a "pay transparency" measure, to close the wage gap among federal workers and in federally regulated sectors, impacting some 1.2 million people.

- The "Advisory Council on the Implementation of National Pharmacare," to be headed by former Ontario health minister Eric Hoskins, which will explore ways to establish a national drug program.

- $3.2 billion over five years for Canadian science and research, including money for granting councils and Canada Research Chairs, upgrading outdated laboratory facilities and harnessing the power of "Big Data."

- $2.6 billion over five years for a wide array of measures to encourage and foster scientific innovation and gender equality in the field, including encouraging female entrepreneurs and business leaders, revamping procurement and expanding access to broadband internet.

- A federal deficit of $18.1 billion, including a $3-billion "risk adjustment," down from $19.3 billion last year, that's projected to decline slowly over the next several years, reaching $12.3 billion ($9.3 billion without the $3-billion cushion) by 2022-23.

- About $1.4 billion over six years to support Indigenous children in foster care and promote family reunification, plus $400 million over 10 years to upgrade and expand Inuit housing and $500 million for Metis housing.

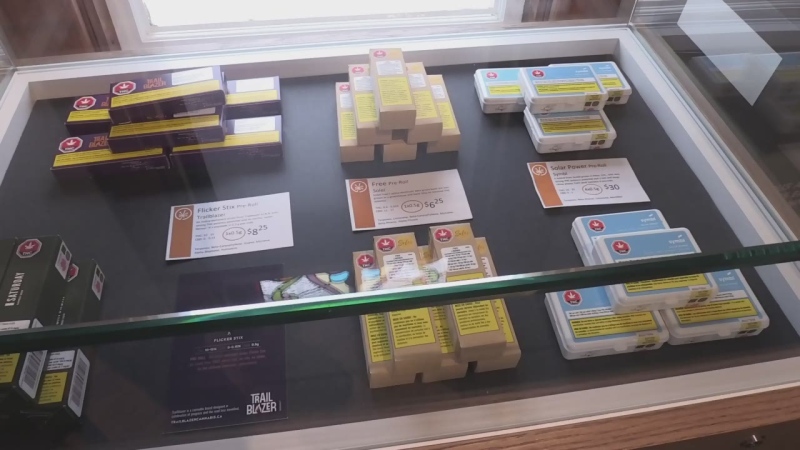

- Higher excise taxes on tobacco products, including a $1 increase on a carton of 200 cigarettes and an adjustment that would see taxes increase with inflation every year, rather than every five years.

- $1.2 billion over five years and $344.7 million a year afterward for a new employment insurance parental sharing benefit that would provide additional "use-it-or-lose-it" benefits for non-birthing parents to encourage women to re-enter the workforce.

- $2 billion over five years for international aid through a new International Assistance Innovation program, designed to come up with flexible new financing arrangements, and the Sovereign Loans program.

- $155.2 million over five years for a new Canadian Centre for Cyber Security and $116 million over five years for the RCMP to create a National Cybercrime Co-ordination Unit.

- $448.5 million over five years to double the number of placements under the Canada Summer Jobs program by 2019-20.

- $172 million over five years and $42.5 million a year afterward for the Canada Media Fund to foster the growth of Canadian-produced content.

- $50 million over five years to support "local journalism in underserved communities," and plans to explore new models that would allow private and philanthropic support for "non-profit" journalism, including allowing Canadian newspapers to receive charitable status.

- $75 million over five years, with $11.8 million a year afterward, to bolster Canada's trade ties with China and Asia.

- $191 million over five years to support jobs in the softwood lumber industry, including litigation under the World Trade Organization and NAFTA's dispute resolution mechanism.

- $90.6 million over five years to track down tax evaders and avoiders, plus $41.9 million over five years and $9.3 million a year thereafter to help Canada's courts deal with the additional caseload.

- Changes to income sprinkling, passive investment income and the small business tax rate that are expected to save the government $925 million a year by 2022-23.

- $173.2 million in 2018-19 to support claim processing and to improve border security to better manage the increased number of people seeking asylum in Canada.